How to Troubleshoot the Account Card in Collection-Master

Collector Account Card Introduction

Other with Interest Calculations

Goal

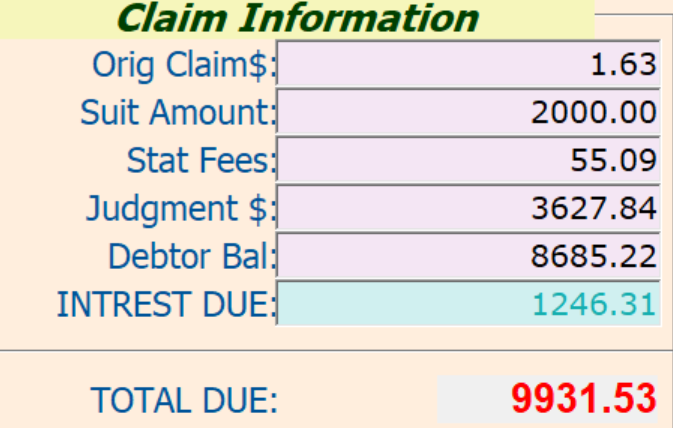

The goal of this document is to better understand how the calculations work in the Collector Account Card. This includes legal calculations, interest, and other components. This sample is a fictional case and is intentionally configured to have unusual amounts.

WARNING: This document covers advanced math, and MATH IS HARD!

Collector Account Card Introduction

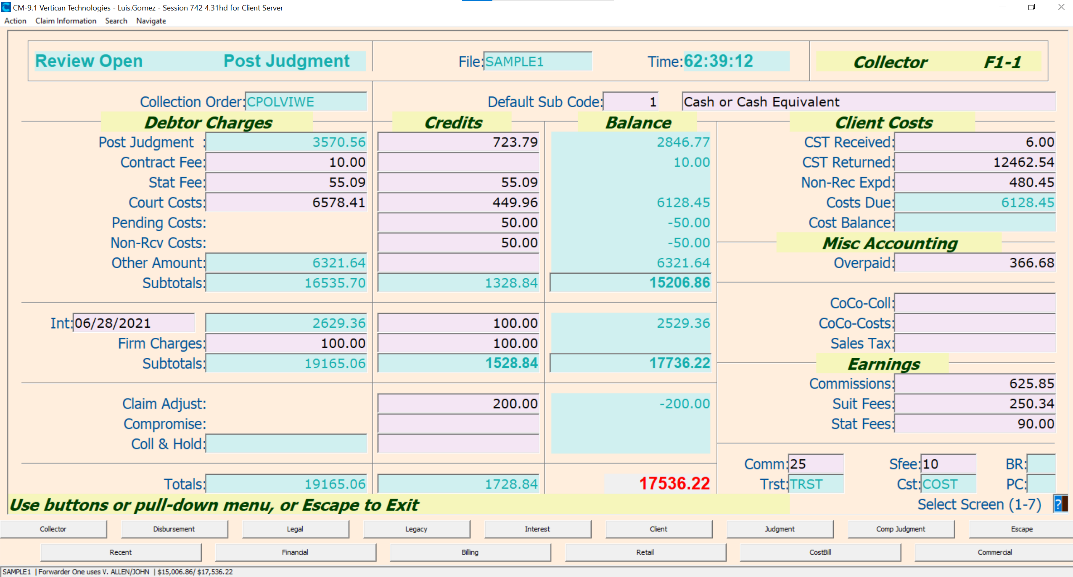

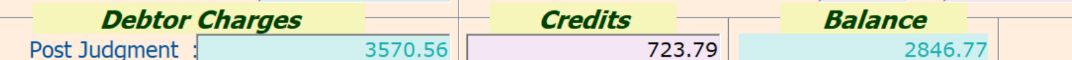

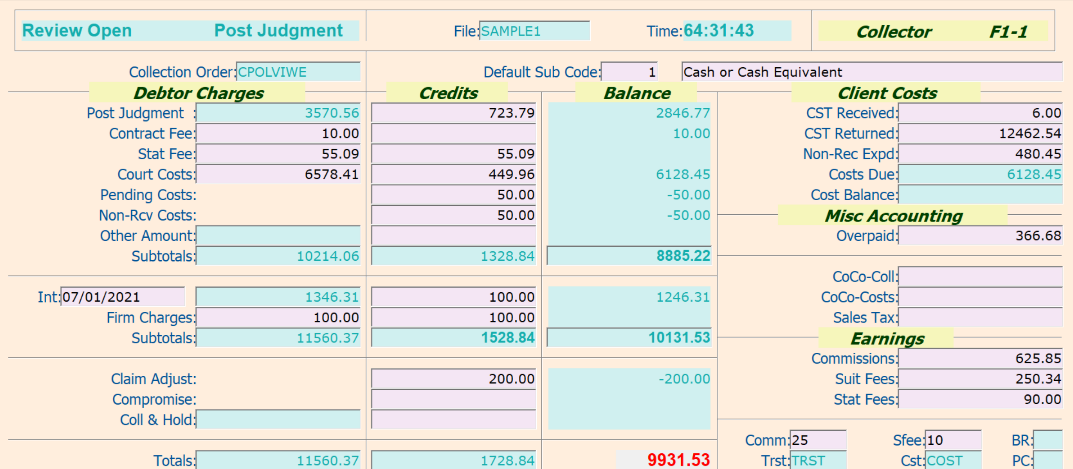

The Collector Account Card is arranged in Charges, Credits, and Balance. There are also additional accounting fields on the right side. Some of these fields are directly mapped to corresponding fields in the database and others are calculations.

Setup Debug Mode

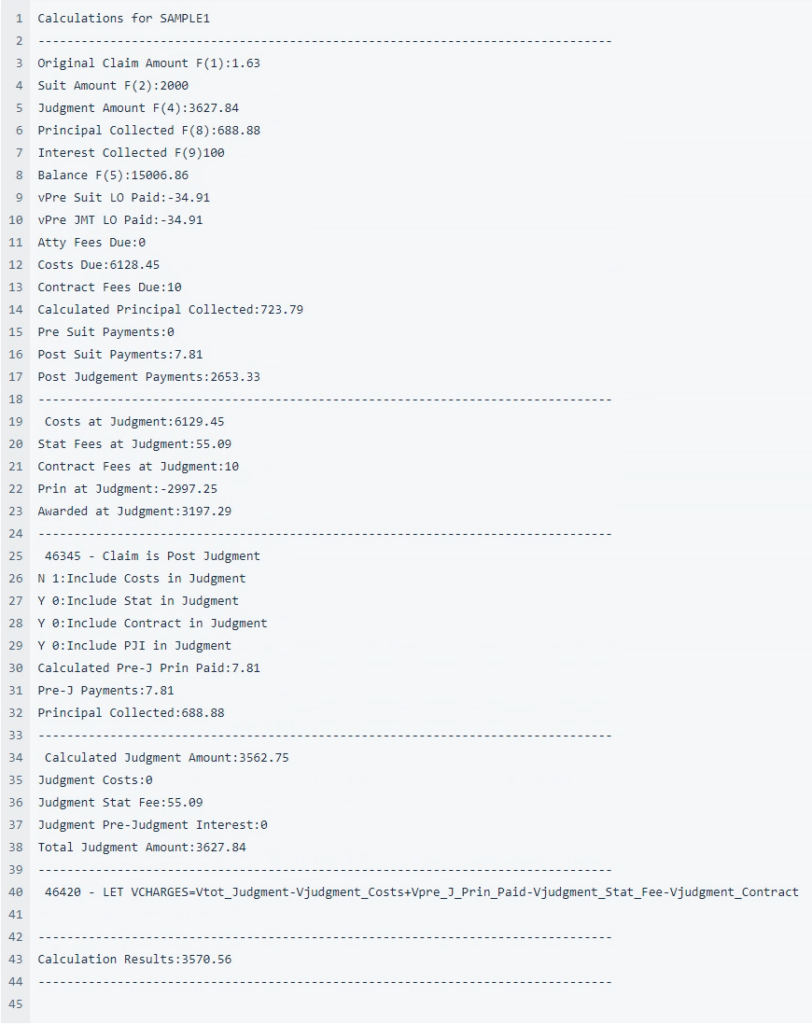

There is a command that will create a debug report for the Account Card calculations and provide detailed debug information about the calculations. There are many variables, including the status of the claim, as well as multi-state settings.

To turn on the debug mode:

Go to the Main Menu

- 0

- let setenv(“DEBUG_INTEREST”,”YES”) ← {Enter]

- PROC RUN ← {Enter]

Once you have enabled debug mode, it will remain active, and every time the account card/interest is calculated, a report will be created in F:\CLSINC\TEMP\[SESSION]\VCHARGES-[SESSION].HTM.

In the sample account card above, the session is 742, so the temp file would be called: F:\CLSINC\742\VCHARGES-742.htm.

This provided sample is intentionally strange to demonstrate the various components used for the calculations.

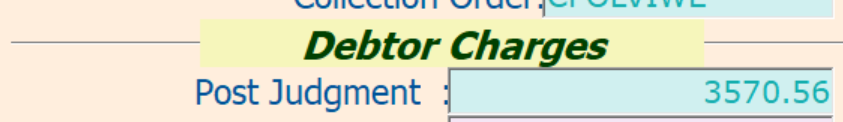

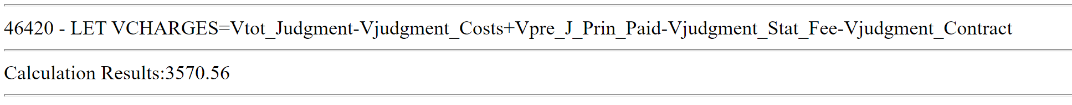

In this case, the result: Calculation Results:3570.56

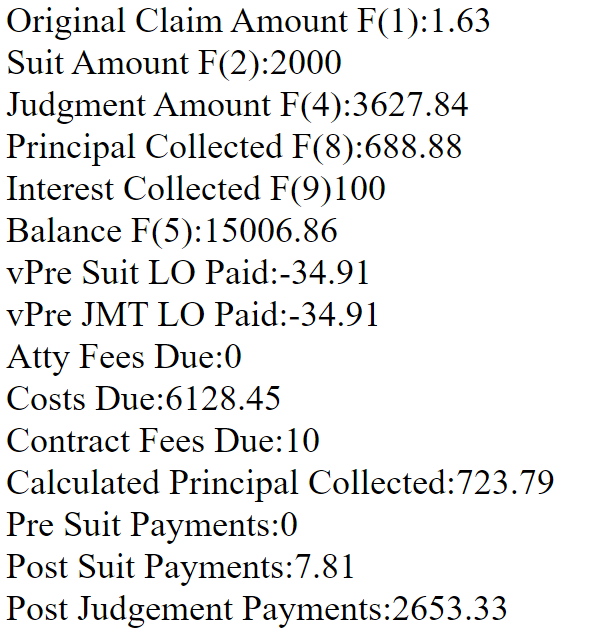

The first section of the debug report returns various Account Card values:

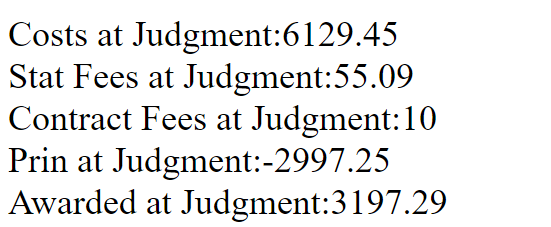

The second section returns the Judgment components:

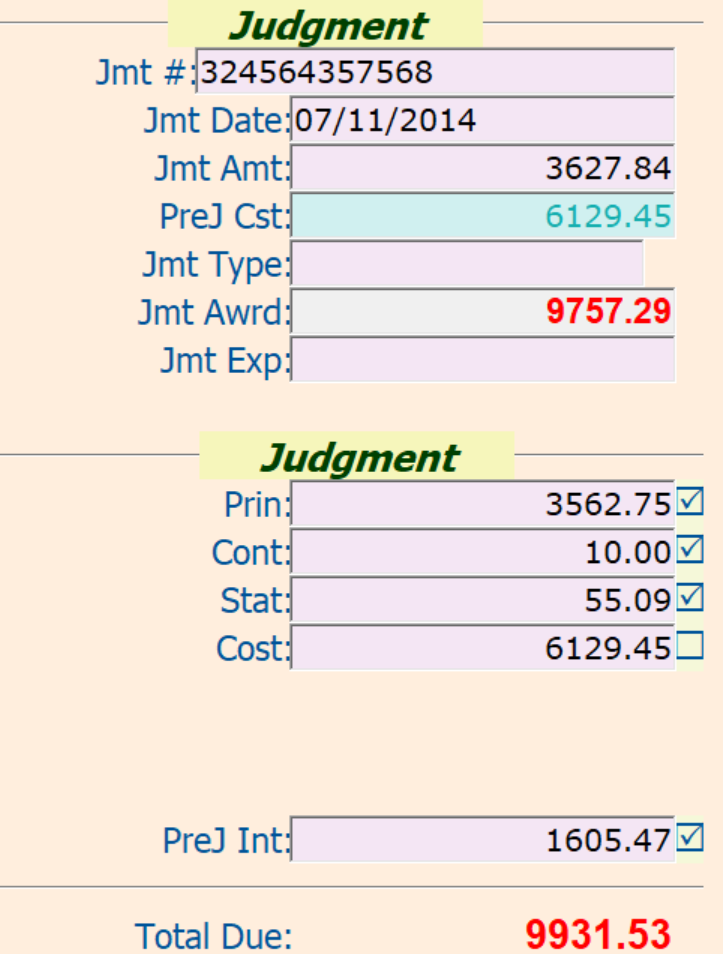

Please note that the Judgment Awarded of 3,197.29 is the sum of the components. Also, note that based on the values of this claim, Principal Awarded is -2,997.25. In this case, Costs at Judgment are much more than the judgment awarded.

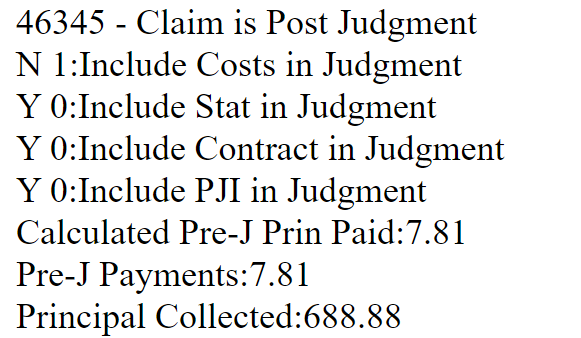

The third section describes the judgment flags:

You can see, based on the Judgment fields, that costs are not included in the Judgment Amount (#3,627.84).

To make things more confusing, the Total Due of $17,536.22 requires an Other Amount of $6,32164 to be charged to the claim.

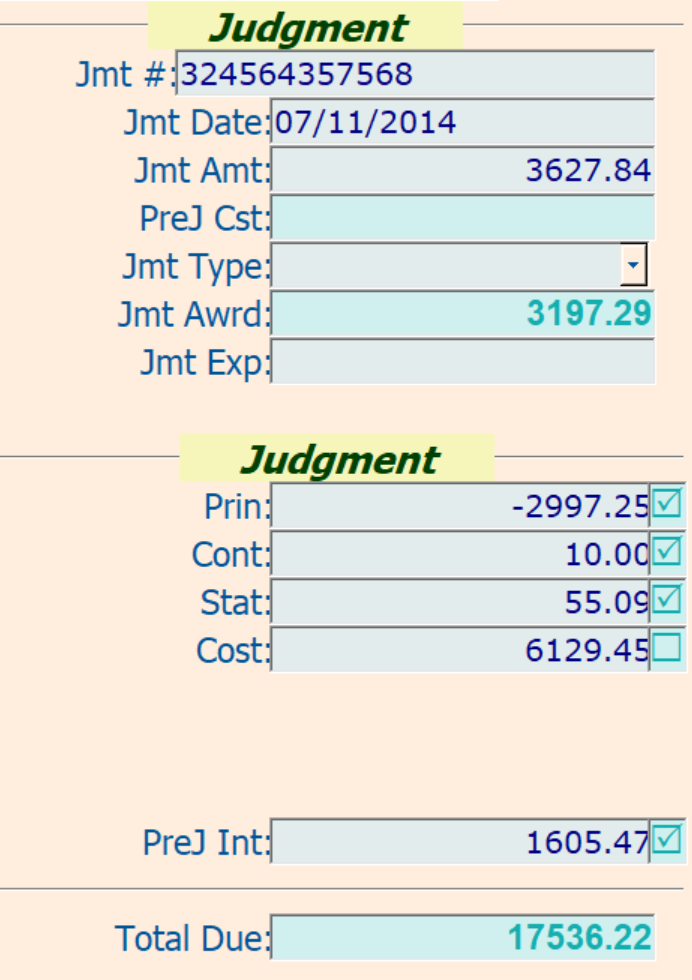

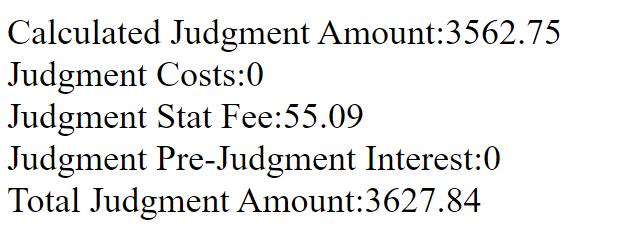

The fourth section displays the Calculated Judgment Amount as well as the Total Judgment Amount. Based on the Judgment Flags, Judgment Awarded is $3,627.84; the Calculated Judgment Amount subtracts Judgment contract fees (10.00) and Judgment Stat Fees (55.09) = $3,562.75.

Finally, vCharges (Charges Post Judgment) is calculated as follows:

Note: Judgment Costs are $0.00 because costs are not part of the Judgment Amount.

3,627.84 – 0 + 7.81 – 55.09 – 10.00 = 3,570.56

Judgment Principal

Judgment Principal is a calculation that takes the Judgment Awarded (3196.29) and deducts the Pre-Judgment Interest (if appropriate), as well as the other judgment components.

Vtotal_Jmt_Awarded-Master_Data(Master_Accr_Int_Bef)*Jf_Prejint-Sum(Mat Master_Data(Master_Jmt_Cost:Master_Jmt_Contract))

This sample claim was picked because it has strange values. The total judgment awarded is less than the sum of its components, so the Judgment Principal = -2,997.25.

| Fields | Value |

| Vtotal_Jmt_Awarded | 3,197.29 |

| Total = Master.JMT_PRIN | -2,997.25 |

Other Amount

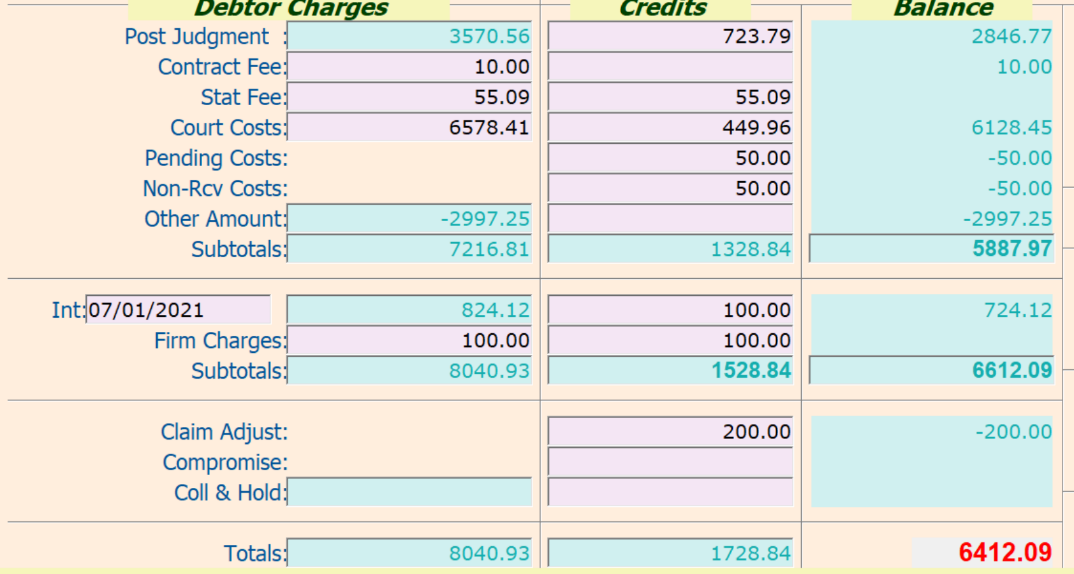

The Collector Account Card is made up of Charges, Credits, and Balance.

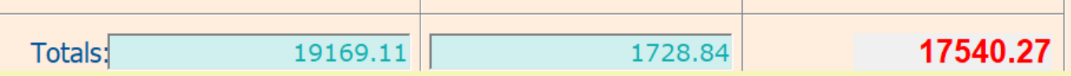

It starts with Principal Charges and Ends with Totals.

In between, there are various buckets that are itemized. If you add up all the Charges and apply for the credits, you end up with a Balance. The Balance is the total payoff, including interest through today.

Note: You may change the Through Date to estimate the interest calculations through a particular date. If you do, the other values will change as appropriate.

In the event that there is a discrepancy in the balance, there is a special field called Other Amount.

In this example, 6,321.64 was applied to Other Amount. The operator tried to fix the judgment principal problem and charged too much to the balance.

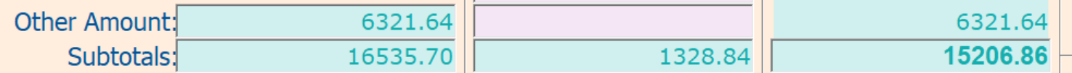

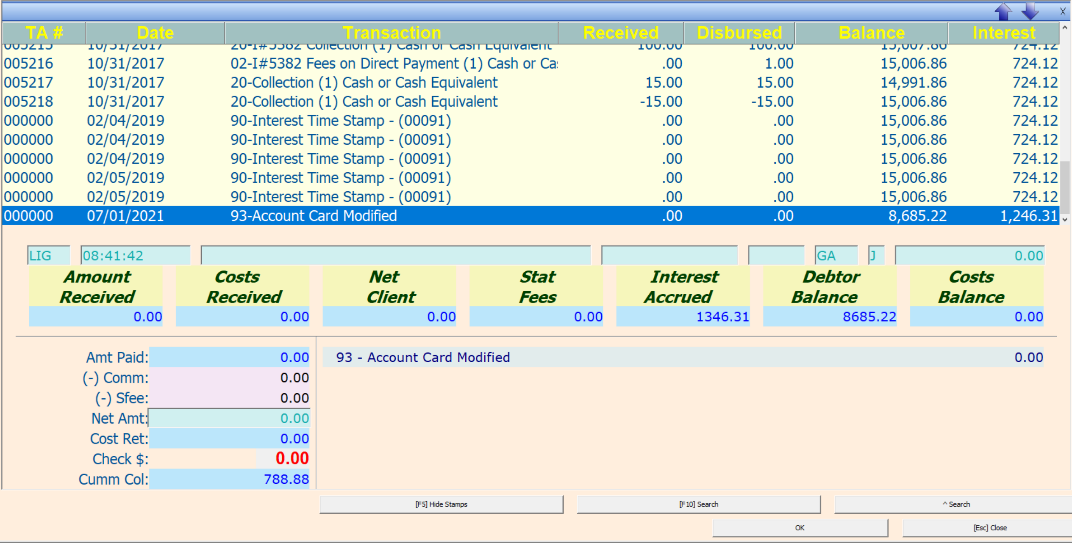

The Legacy Account Card shows the Debtor Balance of 15,006.86, which is 6,321.64 higher than it should be. The Balance should be 8,685.22.

Note: While changing the balance will usually address the “Other Amount,” it’s not always the correct answer. There are cases where an Other Amount is appropriate.

Using the situation where the Judgment awarded really was -2,997.25 as principal, we need to reduce the debtor balance to 5,687.97.

Note: This sample case is very strange; it would be very unusual for the judge actually to award -2,997.25; in this example, I would think that the intention was to award less costs. Since this is a fictional case, we will never know.

After adjusting the balance, the account card looks like this:

Interest Account Card

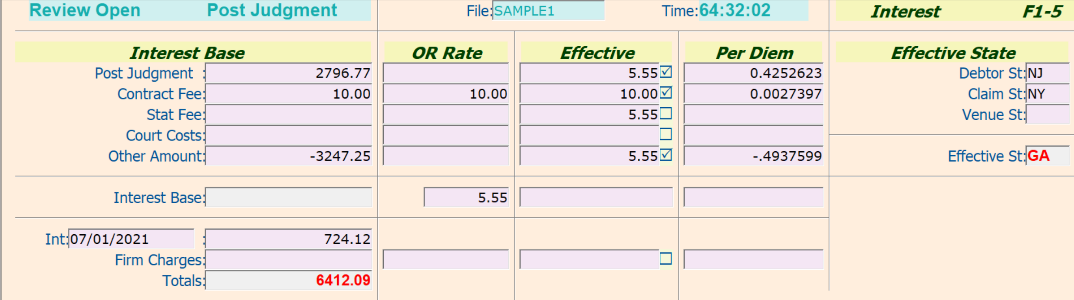

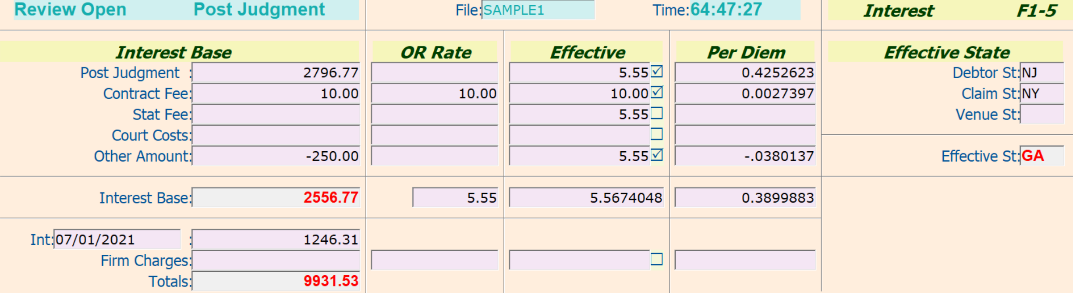

The interest Account Card provides insight into how interest was accrued.

This screen shows the components that are part of the interest calculation. Since components that are not involved in the interest calculation are not displayed, this is not a Payoff Screen, so use the Collector Account Card instead.

The OR Rate field as you see on the contract fee is the Post Judgment Interest Override Rate. If you enter a value in this field, it will change the interest applied to that bucket. While you cannot override to 0%, you can select .0001 or even -.0001.

Notice in this example that the Other Amount per diem is ![]() and greater than the other components. In this configuration, interest will not accrue.

and greater than the other components. In this configuration, interest will not accrue.

Affidavit Amount

The Affidavit Amount is calculated by the judgment wizard and should be Costs + Stat Fees at the time of judgment. In this sample, Stat Fees are 55.09 and Costs are 6,129.45 so the Affidavit Amount should be 6,184.54.

This discrepancy explains why the Judgment Awarded was so low. The change from -375.46 to 6,184.54 is a change of 6,560.

After making this change, the Judgment calculations make much more sense.

Adjusting the balance to 8,685.22 removes the adjustment balance.

After these adjustments, the Collector Account Card looks much better!

As the Account Card was updated, the financial trail shows a new entry reflecting the changes.

Other with Interest Calculations

The Principal portion for interest calculation reflects adjustments and other calculations such as Pending and non Recoverable costs recovered.

In this example, 50.00 of the Principal Charges are applied as Other even though the account card does not have another amount populated. The $50.00 comes from NR Costs Recovered; 200.00 of Claim Adjust is also applied as Other for a total of -250.00.

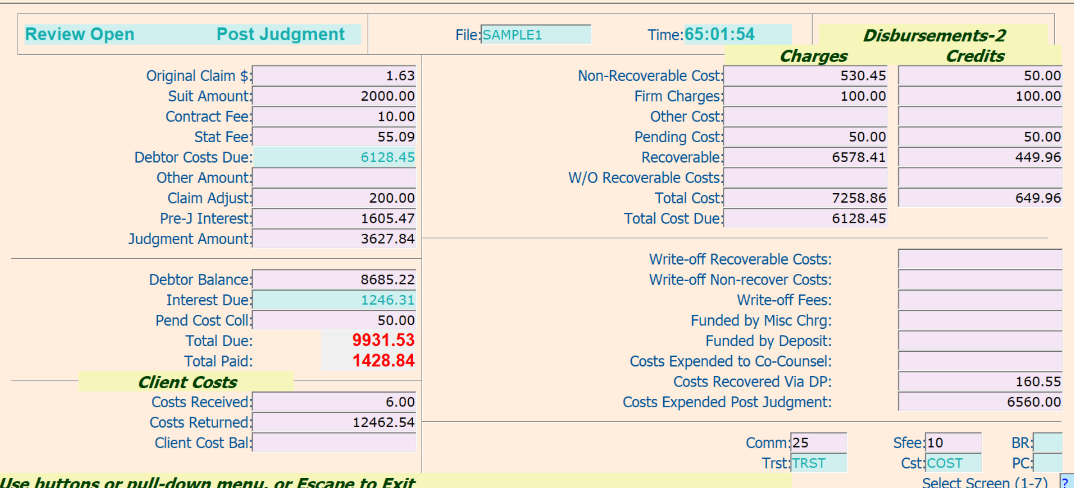

Disbursement Account Card

The costs Account Card shows Claim Information on the left side and then breaks down costs into various categories on the right side. Costs can be quite complicated, particularly as it pertains to pending costs. In the end, it all boils down to a single Total Cost Due: 6,128.45, which is the balance of Court Costs in the Collector Account Card.